At the start of the COVID-19 pandemic in 2020, the federal government signed into law the Coronavirus Aid Relief and Economic Security Act (CARES Act)(1). This included a foreclosure moratorium allowing homeowners who were struggling with keeping up with their mortgage payments the opportunity to temporarily suspend payments during the pandemic. Section 4022 of the CARES Act also included eviction moratorium(2). In addition, federal housing agencies expanded repayment options and proposed new rules to limit foreclosures, and many states put foreclosure moratorium into effect as well.

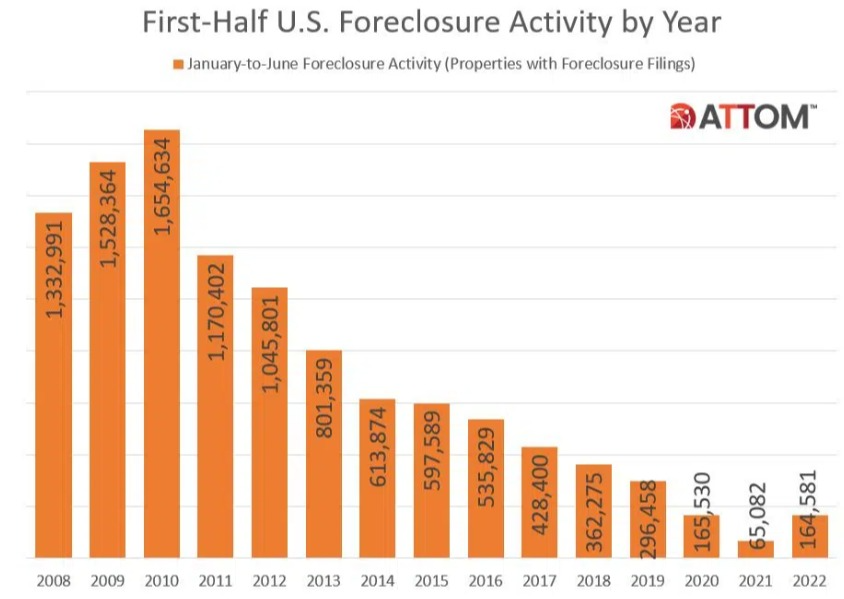

Consequently, foreclosure filings in 2021 were down 78% from 2019. As of 2022, the federal foreclosure and eviction protections, as well as most of the state moratoriums have expired. However, homeowners who are struggling to keep up with their payments due to financial hardship as result of COVID-19 may still be eligible for mortgage forbearance plans(2). With the majority of federal and state foreclosure protections expired, foreclosure activity has seen a slow but steady increase, and has now returned to pre-pandemic 2019 level nationwide(3). With that being said, foreclosures in 2019 were fairly low from a historical perspective.

Graph Image from https://www.attomdata.com/news/market-trends/foreclosures/attom-midyear-2022-u-s-foreclosure-market-report/

What To Do If You Are Struggling With Keeping Up With Mortgage Payments

Are you struggling to make your monthly mortgage payments? If so, you are not alone. In 2021, approximately 1 out of every 10 homes was in foreclosure (4). If you find yourself in this situation, it is critically important to contact your lender as soon as possible to explore options for catching up on payments and preventing foreclosure.

Late mortgage payments will usually incur penalties or fees. Late payments over 30 days may be reported to the national credit bureaus.

The following are options to consider if you are having trouble affording your mortgage payments.

1. Mortgage Forbearance

If you are struggling to make your mortgage payments, mortgage forbearance may be a good option for you. Mortgage forbearance allows you to temporarily stop making payments on your mortgage. This can be a good option if you are facing financial hardship, such as a job loss or medical emergency. Mortgage forbearance can also help if you are behind on your mortgage payments and need some time to catch up. Mortgage forbearance is usually offered for a period of three to six months, but it can be extended if necessary. If you decide to go into mortgage forbearance, it is important to remember that you will still owe the money that you don’t pay during the forbearance period. Once the forbearance period ends, you will need to start making mortgage payments again. You may also be responsible for paying any fees associated with the mortgage forbearance. Before considering mortgage forbearance, be sure to talk to your lender about all of your options and what is best for your situation.

2. Loan Modification

Mortgage loan modification is the process of changing the terms of an existing mortgage loan. The modification can include a change in the interest rate, the length of the loan, or the monthly payment amount. Loan modifications are often used to help borrowers who are struggling to make their mortgage payments. The goal of a loan modification is to make the mortgage more affordable for the borrower, which can help to avoid foreclosure. In order to be eligible for a loan modification, borrowers typically need to demonstrate financial hardship. Borrowers who have experienced a significant drop in income or who have incurred unexpected medical expenses may be able to modify their mortgage. If you are struggling to make your mortgage payments, you may want to consider seeking a loan modification. Speak with your lender about your options and see if a loan modification is right for you.

3. Sell Your Home

Facing foreclosure can be a daunting prospect. Another option is to sell your home. This option may be ideal if your home is worth more than what you owe on it. By selling your home, you can pay off your mortgage and any other outstanding debts, and walk away with some cash in hand. It is important to consult with a real estate agent or attorney to ensure that you understand the sale process and any potential pitfalls. Selling your home may not be the right option for everyone, but it is worth considering if you are facing foreclosure.

4. Short Sale

A short sale is when the homeowner sells their home for less than the mortgage balance. This can happen when the homeowner is unable to make their mortgage payments and is facing foreclosure. The lender may agree to a short sale in order to recoup some of the money that they are owed, rather than going through the foreclosure process. In a short sale, the proceeds from the sale go towards paying off the mortgage, and any remaining debt is forgiven. This can be a difficult process for the homeowner, as they will likely have to negotiate with their lender and may need to find a new place to live. However, a short sale can be a better option than foreclosure, as it will not have as damaging an effect on the homeowner’s credit score.

5. Bankruptcy

Facing foreclosure can be a stressful experience. If you’re behind on your mortgage payments, you may be wondering if bankruptcy is the best option for you. While bankruptcy won’t erase your mortgage debt, it can give you some breathing room to catch up on payments. Bankruptcy can also help you avoid foreclosure by putting an automatic stay in place. This means that your creditors cannot take any collection action against you, including foreclosing on your home. A Chapter 13 bankruptcy will allow you to get caught up on your past due mortgage payments over a 3-5 year period. In a Chapter 13 bankruptcy you will start to pay your regular mortgage payment again as well as a monthly payment to the Chapter 13 trustee. The monthly payment to the Chapter 13 trustee will take care of the past due mortgage payments as well as any other debts that you have. If you’re considering bankruptcy, it’s important to speak with an experienced Nebraska bankruptcy attorney to learn more about how it can help you avoid foreclosure.

How To Avoid Mortgage Relief Scams

Mortgage relief scams are on the rise as homeowners struggle to keep up with their payments. These scams usually involve a company promising to help you modify your loan or get a lower interest rate. Sometimes, the company will even claim that they can get your mortgage payments reduced or eliminated altogether. However, these claims are almost always false, and the companies will often charge high fees for their services. If you’re struggling to make your mortgage payments, it’s important to be aware of these scams and how to avoid them.

There are several red flags that you should be aware of if you’re considering working with a company to modify your mortgage. First, be wary of any company that requires upfront fees before they provide any services. Second, beware of companies that guarantee they can get your mortgage payments reduced or eliminated. Mortgage relief is never guaranteed, and any company that makes such claims is likely a scammer. Finally, don’t sign any documents until you’ve had a chance to review them with an attorney or housing counselor. If you’re considering working with a company to modify your mortgage, make sure you do your research first and avoid becoming the victim of a scam.

Get Professional Help and Advice

If you’re facing foreclosure, it’s important to seek professional help as soon as possible. Nebraska bankruptcy attorney, Thomas McGuire, can evaluate your situation and advise you on the best course of action. Bankruptcy can stop a foreclosure in its tracks, but it’s not the right solution for everyone. Mr. McGuire can help you weigh the pros and cons of bankruptcy and make the best decision for your situation. Don’t wait until it’s too late to get help – schedule a consultation today.

Notes

1. https://en.wikipedia.org/wiki/CARES_Act

2. https://www.ncua.gov/regulation-supervision/letters-credit-unions-other-guidance/navigating-and-understanding-end-pandemic-era-homeowner-protection-programs

3. https://www.attomdata.com/news/market-trends/foreclosures/attom-august-2022-u-s-foreclosure-market-report/

4. https://www.statista.com/statistics/798766/foreclosure-rate-usa